Managing your finances doesn’t have to be overwhelming.

Whether you're just stepping into the working world or looking to make smarter financial decisions, our webinar, “Mastering Money: Essential Financial Skills for Life,” offered invaluable advice for navigating the world of finance.

The session, led by Funmi Olufunwa, a finance expert with over 20 years of experience, broke down complex financial topics into digestible tips anyone could apply.

Missed the webinar? No worries - we’ve compiled a comprehensive overview of the event so you can start mastering your money today.

Why we need to talk about money

Confidence and knowledge gaps about money are common. Funmi, the founder of Hoops Finance, shared how financial literacy plays a crucial role in personal empowerment. Yet, many people don’t feel comfortable discussing finances openly.

Key topics discussed

- How to decode your payslip and avoid paying extra tax.

- Top strategies for managing and budgeting money effectively in 2025.

- Tips to increase your income without burning out.

1. Decoding your payslip

Fun fact: Did you know that £5.8 billion in taxes is overpaid annually in the UK due to incorrect tax codes? Funmi started the session by teaching attendees how to examine their payslips for errors and ensure all deductions make sense.

Payslip basics

Your payslip tells a story, yet Funmi explained how 43% of people don’t always check their payslips. She walked through its three main sections (beginning, middle, and end):

- Gross pay (beginning): The total amount your employer pays before deductions.

- Deductions (middle): This includes taxes like PAYE income tax, National Insurance, and pension contributions.

- If you earn over £10,000 and are aged 22 or over, you will automatically be enrolled on a workplace pension scheme.

- Pensions are a tax-efficient way of saving for your future.

- You may receive additional deductions on your payslip, such as workplace benefit schemes, so make sure you understand what they are.

- Net pay (ending): The amount that lands in your account.

The payslip should also include additional information, such as:

- National Insurance number: Ensure this is correct so your payslip is linked to you, not someone else.

- Payment period: This is how often you receive your pay, so ‘monthly,’ ‘weekly,’ etc.

- Payment method: This is how you’re being paid, usually BACS (automatically deposited into your bank account).

- How much tax you’ve paid in total - information should include how much tax you’ve paid in total and for that specific payslip.

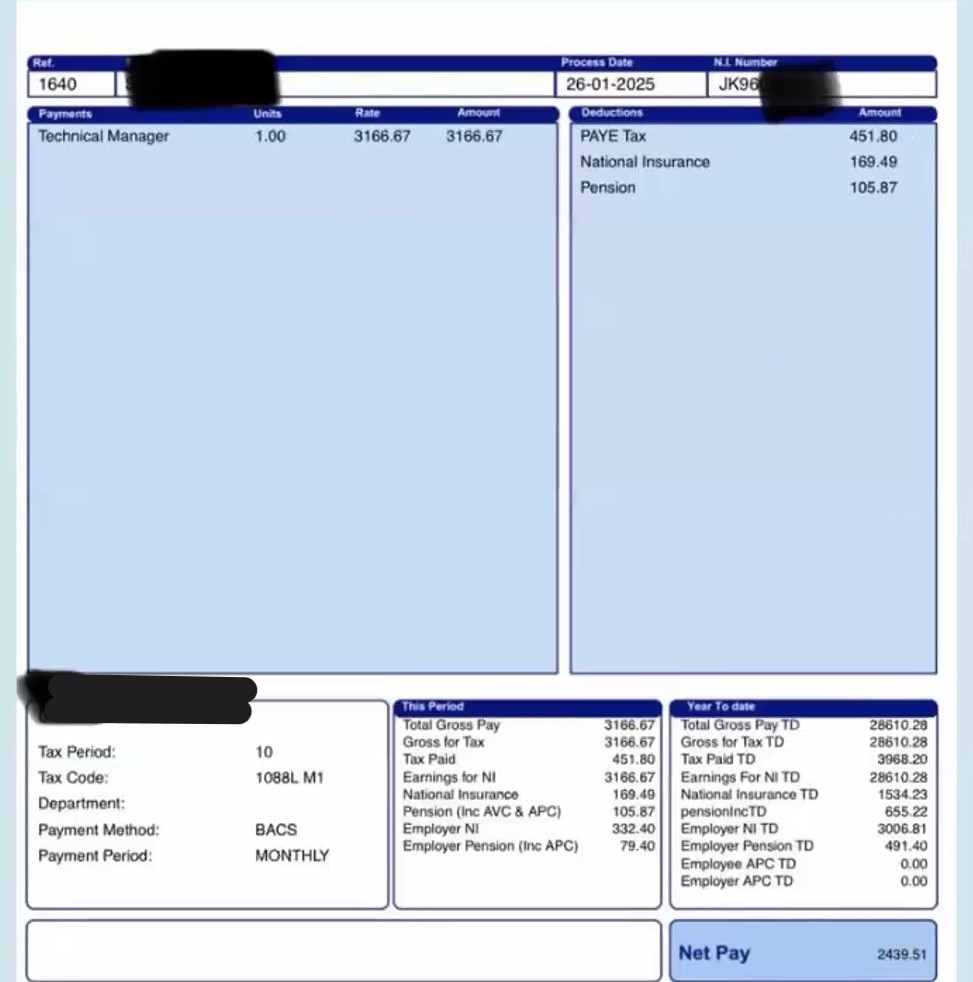

Example payslip

For this person, their payslip shows that:

- Their gross pay is £3166.67.

- They receive deductions for PAYE income tax, National Insurance, and their pension.

- Their net pay after deductions is £2439.51.

The importance of tax codes

To understand your tax code, remove the letter and add a zero. For example, 1088L means you pay tax after earning £10,880, and 1257L means that you pay tax after £12,570.

Funmi spoke about how tax codes impact earnings. For example:

- A standard tax code (1257L) lets individuals earn £12,570 tax-free. (most people are on this).

- Changes to your tax code can indicate underpaid or overpaid taxes. If your tax code is not 1257L, it’s important to understand why.

- For example, the government may gradually recoup the tax if you cannot pay what you owe in one payment. In this case, you would pay tax sooner than £12,570, so you would be on a different tax code.

Key takeaway: Review your payslip to ensure your net pay matches your bank deposit. If something seems off, contact your HR team or HMRC.

Tax bands

In the UK…

- Personal allowance: You will pay no income tax if you earn up to £12,570 (1257L).

- Basic rate: Once you earn over £12,570, you will pay 20% income tax on anything above £12,570 up to £50,270.

- Higher rate: If you earn between £50,271 to £125,140, you will pay 40% income tax.

- Additional rate: You lose the tax-free personal allowance if you earn over £125,140. Your income will be taxed at different rates: 20% on income up to £50,270, 40% on income up to £125,140, and 45% on all income exceeding £125,140.

- Over £100,000: The government will gradually reduce the tax-free personal allowance if you earn between £100,000 to £125,140.

The tax bands in Scotland are different and can be found on the UK government website.

National Insurance deductions

Funmi explained that paying National Insurance gives you National Insurance Credits, which count towards your state pension entitlement. She shared how you can check your National Insurance record by creating an account with HMRC to ensure that all the years you’ve been paying your National Insurance are correct.

Pension types

- State pension - the government provides this if you’ve earned enough National Insurance Credits.

- Workplace pension - the pension your employer sets up that you can see deducted from your payslip.

- Personal pension - you can set up your own pension if you are self-employed, for example.

2. Managing your money in 2025

With the rising cost of living, having a plan for your finances is vital. Funmi emphasised the importance of knowing your numbers (what's coming in and out - payslips and bills, etc) to create a realistic budget.

The goal is to have more money coming into your account than going out so that we can save towards our goals.

Steps for smarter money management

- Track your spending: Funmi suggested reviewing your bank statements from recent months to identify necessary purchases or recurring subscriptions. She also advised assessing payslips from February onwards, often providing a more accurate overview of your spending.

- Set realistic budgets: If food prices have gone up, adjust your budget accordingly to avoid sticking to outdated figures. It is common for people to struggle with budgeting when they have not revised their realistic costs of living.

- Focus on joyful spending: In addition to essential bills, prioritise spending your money on things that truly matter to you and bring you happiness.

Various tools, such as spreadsheets, banking and budgeting applications, or even simple pen and paper, are recommended to keep track of your spending. The key is to find the system that works best for you.

Tip: Use budgeting tools, but don’t feel pressured to adopt complicated apps if they don’t suit your workflow. Sometimes simplicity is best.

Planning ahead

Funmi encouraged attendees to look ahead at their financial timelines. They should consider upcoming expenses, such as bills or renewals, and plan for any later financial surprises.

When setting goals, follow a SMART framework and work backwards from what you need. For example, if you want to save £1,000 in 10 months, work out how to save £100 monthly.

Additional insight: A main bank account is useful, but diversifying where you keep your funds can protect you from technological issues (e.g., bank outages).

3. Boosting your income

Who doesn’t want to earn more? But it’s not just about working harder. It’s about working smarter.

Funmi covered several practical options for boosting your income:

- Side hustles: From affiliate marketing on social media channels to selling unused items on Vinted, side jobs can bring in more cash.

- Claim what’s yours: An incredible £23 billion of state support goes unclaimed annually. Use tools like the government’s benefits calculators to check your eligibility for credits, discounts, or other aid.

Funmi recommended avoiding ‘hustle culture’ and focusing on financial sustainability and meaningful goals. While additional income streams can be beneficial, they should be balanced with rest and well-being.

Funmi also reminded attendees, “We’re human beings, not human doings.”

Credit and savings tips

To further maximise financial opportunities:

- Improve your credit score: Use credit responsibility by paying on time and keeping balances low.

- Optimise savings accounts: Look for accounts offering the same interest rate as the Bank of England or higher.

Key highlights from the Q&A Session

The session concluded with a lively Q&A where attendees gained additional insights on:

- Joint accounts and credit: Funmi explained how joint accounts link credit files, which can affect your credit score. Always be cautious about whom you open accounts with.

- Building credit as beginners: Those new to savings and credit were advised to start small by using mobile phone bills, utility bills, or responsible credit cards to establish a positive credit history. They were also advised to check comparison websites like MoneySupermarket for current, credit, and savings accounts.

- Understanding your credit score: Funmi explained that there are three leading credit reference agencies in the UK: Experian, TransUnion (formerly Callcredit), and Equifax. Each has access to different information, so your credit score isn’t the only factor assessed when you apply for credit or loans. Other factors include whether you’re on the electoral register, salary, and spending habits.

Take your financial skills even further

Want to take control of your finances and turn your financial knowledge into a rewarding career? Explore our accountancy courses today and unlock a world of opportunities.

If you have any additional questions about our courses, contact our Student Services team via studentservices@kaplan.co.uk.

Please note: The purpose of the webinar is to increase awareness of financial matters but does not constitute financial advice. We recommend seeking out individual advice regarding your own circumstances if required.