The topics we will discuss to help you revise for your Advanced Taxation (ACCA ATX) exam include:

- The core areas and objectives of the exam

- How the exam is structured

- Challenges

- An example exam question

- A step-by-step guide on how to approach the question

- Additional resources

The Advanced Taxation (ACCA ATX) subject is an optional unit within the ACCA Strategic Professional level. It is a great option if you work in tax, want to learn more about the UK tax system, or enjoyed the ACCA TX-UK exam in the Applied Skills level.

The content for this subject is highly relatable, as we all interact with taxes throughout our lives. This subject also helps you understand what happens to your money and encourages you to think about your future plans, particularly if you hope to run your own business. If you’re planning to set up a business, ACCA ATX will equip you with the skills to decide whether you’d set it up as a sole trade or through a company.

Tax will always be one of your most significant expenses, so it’s definitely worth knowing how it works.

What are the exam topics?

This exam cannot be selectively studied as we are examined on a whole host of taxes such as:

- income tax

- national insurance contributions (NICs)

- inheritance tax (IHT)

- capital gains (CGT)

- corporation tax

- value added tax (VAT)

- stamp taxes.

These taxes will often be examined together in a scenario where we will have to identify which type of taxes are impacted and tell the examiner the cost.

For example, you may have a client who is asking for advice relating to their new employment contract and how this will be impacted for tax purposes. You need to advise them on each element of the contract that will suffer income tax, and which will and will not suffer NICs. Alternatively, you may advise the employer to identify the employer NICs and additional corporate tax savings on the costs of employment.

Additionally, it could be a larger issue. For example, you could be advising a company on how it may expand its business overseas, discussing whether it should set up a branch or a subsidiary. This wouldn’t just be discussing the differences between the two methods but advising what our client should do based on any information provided.

How is the exam structured?

There are three questions in this exam:

| Section | Number of marks |

|---|

Section A | 50 marks |

Section B | 25 marks each |

We can’t guarantee what topics will be covered in each question. All we can guarantee is that question one will have five marks for ethics and some for business and/or personal taxation.

As such, it’s difficult to structure our revision in a way that specifically targets these questions, as it’s crucial to revise the full syllabus and be prepared for anything.

Within question one, 10 ‘professional skills marks’ are embedded within the 50 marks. Questions two and three have five ‘professional skills marks.’ The vast majority of these marks will be picked up by ensuring you answer the question that’s being asked, and you pick up relevant taxes, reliefs and discussion points in the exam.

Question one will require you to go out of your way to pick up the professional skills marks as you will often be asked for a report, memo, and/or file notes. However, aside from this, your professional skills marks will be collected as you work through the exam as long as you’ve built up your technical knowledge.

With a bit of practice, these marks are easy to pick up, and you can start your exam knowing you’ve already gained a few free marks.

Common challenges and tips for the ACCA ATX exam

This is a fantastic exam, but it does have its challenges.

Foundational knowledge from ACCA TX-UK

Firstly, the syllabus is vast and cannot be selectively studied. One of the biggest problems is usually the lack of knowledge brought forward from the ACCA TX-UK exam.

ACCA ATX builds on the foundation knowledge from the ACCA TX-UK exam. Before starting this subject, ensure you’re familiar with key tax workings from the TX-UK exam. This includes understanding tax income calculations, corporation tax, gains, CGT, and inheritance tax computations for lifetime gifts and death estates. This knowledge will facilitate a smoother transition into the more advanced syllabus and prevent you from feeling overwhelmed.

CGT and IHT questions

There are some topics I see students struggling with quite frequently. One is on the questions that are examining both CGT and IHT, where many people struggle with the different rules for each of the taxes.

This is a tricky section as rules and reliefs often feel similar but are different. For example, a gift of quoted shares must be valued on a comparison between two different methods for IHT, and then there is a completely separate valuation method for CGT. Then, the reliefs on these taxes that will get us out of paying IHT or CGT, such as Business Property Relief or Gift Relief, can often be applied to the same type of assets - yet, the explanations of why these reliefs apply are slightly divergent.

With these types of questions, comparing gifts under each type of tax and building a ‘cheat sheet’ of these differences that you can quickly refer to during your revision phase can significantly help you build your confidence.

Confidence and exam technique

Another common challenge that I’ve witnessed is exam confidence. As we know that the syllabus is so broad, students will often doubt their knowledge, find questions overwhelming, and do not know where to start.

This is why, during our revision phases, I step away from the technical content to take the time to go through how to break down a question. Learning this skill is the most important thing to do in an exam. Looking at a 25-mark question (let alone a 50-marker) can be overwhelming, but it’s not as bad if you know where to start.

Don’t just start reading the question from the top - you’ll see a lot of information, but you won’t know what the examiner wants from you. Therefore, you want to get down to the requirements to get yourself moving.

Example question

Download the model answers after reading the step-by-step guide.

Set yourself on the right path by taking that question and breaking it down. I’ve shown an example below that is taken from our exam kit - written by experts at Kaplan.

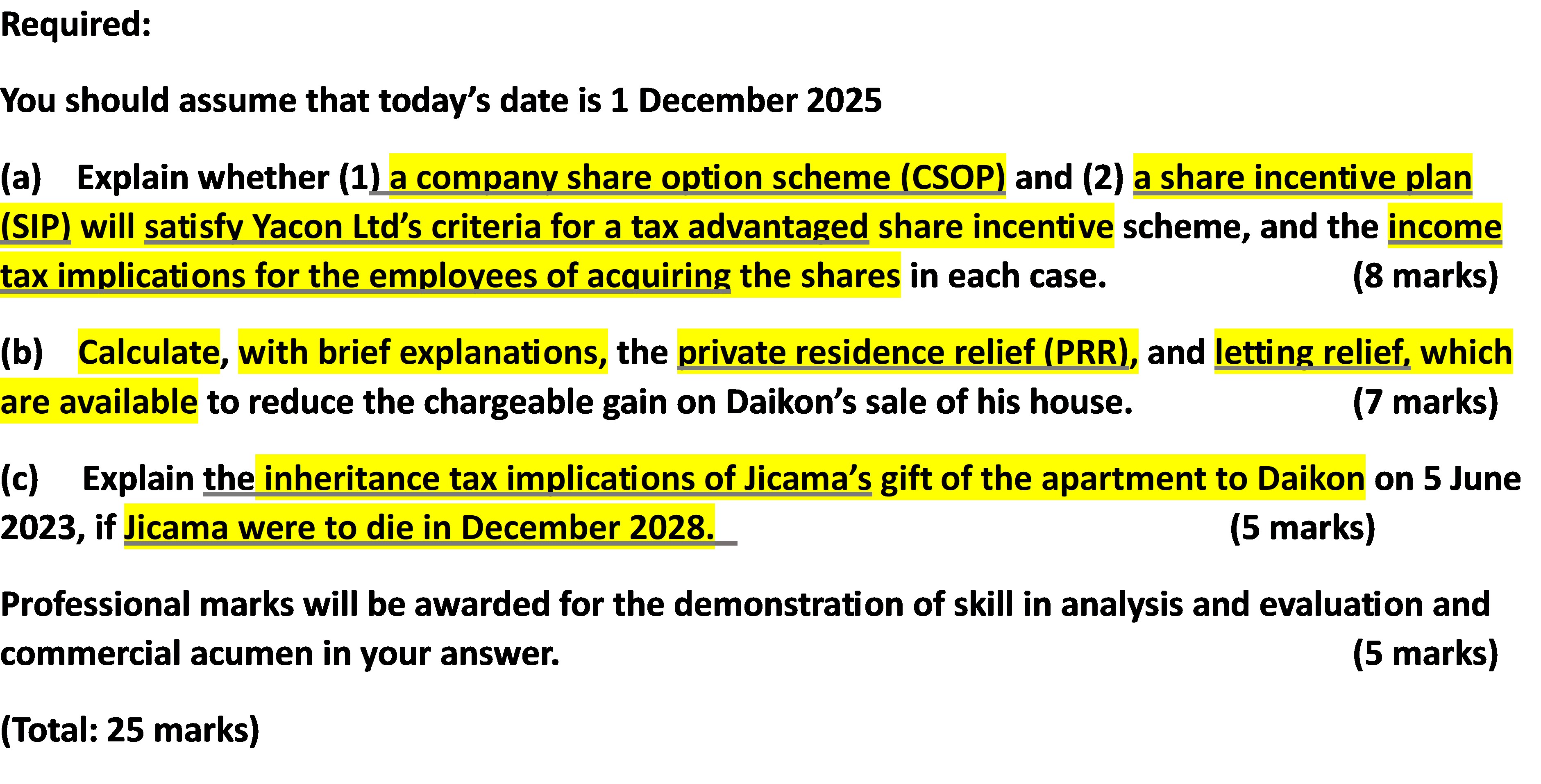

The above 25 mark question is an example of where learners will often struggle with where to start. The easiest part is taking these requirements and getting headings going for parts A, B, and C. It’s not revolutionary, but it’s a start!

Step one - the setup

The next step would be breaking down the sub-requirements themselves - using the information to guide your answer.

Before I’ve even thoroughly read any information, my question paper would look like the following:

PART A - Explanation of whether CSOP will satisfy Yacon’s Criteria

- Explanation of whether SIP will satisfy Yacon’s Criteria

- Income tax implications of acquiring these shares

- If a CSOP

- If a SIP

PART B - Explanation of PRR availability

- Explanation of letting relief availability

- Calculations of both

PART C - Explanation of IHT implications of the gift

- The implication of if Jimica dies in December 2028

For ‘Part A’ I have four subheadings where I’m going to discuss my answer. Instead of diving into an eight-marker, I’ve broken it into four smaller requirements.

Although it’s not going to line up, I would be thinking to myself, “If I can write at least two relevant things under each of those subheadings, then maybe I can pick up all of those marks, or at least feel more confident about getting a pass.”

This would provide me with a psychological boost during the exam while ensuring I answer the whole question. I know that I can’t just discuss whether either of these schemes is appropriate for the company, but then I also need to talk about the impact on employees.

We often see learners focusing on the big part of a requirement, and then they miss a smaller requirement embedded within here. If I break down the question and give myself subheadings, I won’t leave anything unsaid. If, at the end of answering a question, I see a subheading with nothing underneath it, I need to do a double-take to ensure I’ve answered the full question.

Step two - active reading

Actively read all of the information. In other words, read the question and information and actually take it in.

In this stage, you need to start thinking about how this information is going to impact and interact with those subheadings. Again, I wouldn’t necessarily start writing my answers in full as I want to take all of the information from the scenario and start considering where I might be able to get my easiest marks.

You also don’t have to do the exam in order. Personally, I’d likely find ‘Part C’ in this question the easiest, so I would ensure that I start with that question to get the marks. However, you won’t know which part will be the easiest until you’ve read the full question and supporting information.

Under the above subheadings, I note the information from the questions and set up workings that I’d use to write up my answer. This will then give me a view of the full question, and the sections that seem most tricky for me, which will inform me where to start the question.

My plan would then look like the one below.

Step three - the plan

PART A - Explanation of whether CSOP will satisfy Yacon’s Criteria

- want to select E’Ees impact?

- Grant of £3k possible?

- In five years

Explanation of whether SIP will satisfy Yacon’s Criteria

- want to select E’Ees impact?

- Grant of £3k possible?

- In five years

Income tax implications of acquiring these shares

If a CSOP

If a SIP

PART B - Explanation of PRR availability

- Get PRR for actual and ‘deemed’ occupation

- Own home lived in

- Last 9m always exempt

- Restrict since 2021 as renting out 25%

PRR working:

Explanation of letting relief availability

- get some - renting whilst living

- Max availability is £40K, vs PRR and something else

Calculations of both

PART C - Explanation of IHT implications of the gift

- PET, no tax now

- Annual exemptions?

- In 2022 was a GWROB - but now not living there.

The implication of if Jimica dies in December 2028

- IHT 40% if no NRB

- >3 years - so some taper - check tax tables for %

Step four – the write-up

The first two steps will probably take me around a quarter of my time for the question as a whole, but now I’ll know what the content of the entire question is, so I’m in a position to get through the write-up phase.

When writing your answer, don’t just provide a block of text. As a marker, there is nothing worse than being greeted with a full page of text. The enter button on your keyboard is your friend - leave white space and make sure that each paragraph is a maximum of three sentences.

Even if this isn’t how you would write in the real world, it’ll make your answer look cleaner and get you into the marker’s good books!

On the write-up, make sure that you state the obvious to pick up your easy wins. If there’s a rule or exemption, don’t just say it applies - give the marker the rules to say why.

However, the main thing is to make sure you don’t stress over every tiny rule. Too often, I see learners spending 10+ minutes perfecting a calculation or answer that will only give them two marks. The ACCA ATX exam can be time-consuming, so don’t waste your time stressing about each little rule, deal with the big picture. Elephants, not mice!

Make sure you get something under each requirement - usually, the easiest marks are when you start each sub-requirement. It’s easier to get 50% when you are tackling 100% of the exam rather than only 80%.

Additional support and resources

If you’re not already studying ACCA Advanced Taxation with us at Kaplan, give yourself the best chance to pass the exam with our ACCA ATX course. With four study methods, you’ll find a course that’s perfect for you.

When studying with Kaplan, you will have access to the Academic Support team via the ‘contact a tutor’ option on your MyKaplan. They are available seven days a week and can support you with any tricky topics via live chat, email, or by requesting a call back.

And if you have any additional learning needs, get in touch with our inclusion team, who can support you.

Practicing exam-standard questions in timed conditions is essential when preparing for your real exam. Be encouraged to practice questions in the ACCA practice platform when possible.

Alternatively, Kaplan Publishing, an ACCA Content Partner, also offers ACCA Study Texts, Exam Kits, and Pocket Notes - which cover the full syllabus and help you feel exam-confident.