We know we are going to get a consolidation question in the exam and more likely than not we will have to deal with a dividend. This cheat sheet will help you understand the adjustments that you need to make.

If you’re looking to sit your ACA FAR, ACCA FR, ACCA SBR exam, or even potentially the CIMA F1, CIMA F2, or AAT Q22 DAIF papers, you might be concerned about the consolidation question. Subsidiaries pay dividends to their owners (Parent and NCI). Any payments made between subsidiaries and parents are classed as intra-group transactions, therefore they need to be removed.

Let’s have a look at the adjustments.

Consolidated Statement of Profit and Loss

There will be an investment income amount in the Parent’s column which needs to be eliminated. This is the parent’s % of the total dividend paid by the subsidiary.

Kaplan advises that this adjustment should be in the Parent's column, as per the pro forma in your Kaplan Summary Notes.

Please note: The ICAEW do sometimes put this in the adjustments column instead, and either is fine. The reason it doesn't matter either way is: the totals from P's column and the adjustments column in the Working 2 do not feed through to other workings or the Financial Statements (only S's total does) so you get the same final answer either way.

Consolidated Statement of financial position

For group retained earnings this is already dealt with as the RE figure from the subsidiary will have already taken the dividend figure out. In other words, the below journal has been posted in the subsidiary's individual account.

Dr RE *Dividend amount*

Cr Cash *Dividend amount*

This means that when we include our share of the post-acquisition movement in net assets, this dividend has been eliminated.

Consolidated Statement of Cash Flows

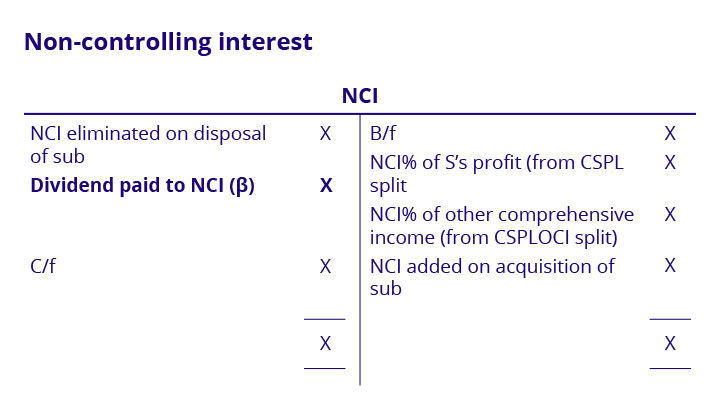

When we are looking at a group statement of cash flows, any dividend paid by the subsidiary to the NCI should be disclosed separately. These will form part of their own line in the Cash flows from financing activities. To work out the dividend we need to follow the below working:

The treatment of dividends (associate and parent) in consolidation

With dividends, these are accounted for as being a deduction from retained earnings when they are paid and so the associate would

DR Retained Earnings

CR Cash

In their individual financial statements.

The parent when they receive them would

DR Cash

CR Investment Income in the SPL

In their individual financial statements.

Consolidated Statement of Profit and Loss

The dividend received from the associate is eliminated from the parent's investment income as, if it isn't, then it is effectively being double counted when you recognise the share of associate profit in the CSPL.

Consolidated Statement of financial position

On consolidation when calculating the value of the "investment in associate" on the CSFP we take the cost of the investment plus the parent's share of the movement in net assets since the date of acquisition.

As net assets include your retained earnings the payment of any dividend would already have been deducted from this and so no adjustment is needed.

Note: If however we were only given the profit that the associate had earned since the date of acquisition then we would add the parent's share of this figure to the cost of the investment and then deduct any dividends that had been received on account of these profits in the year.

Consolidated Statement of Cash Flows

When we have a cash flow question, we are generally given the CSFPs and a CSPL and we are not told the amount of the dividend that has been received from the associate in the year as they want us to calculate it. Therefore, we use the value of the Associate in the CSFP at the start and end of the year. Increase the b/f figure with the profit that the parent would be entitled to in the year and then the missing figure will be the dividends that have been paid (and received by the parent).

Need more advice?

If you are enrolled on a Kaplan course and are studying towards your exam, you can contact a tutor via your MyKaplan for support.

Using your MyKaplan ‘contact a tutor’ option, you can email, live chat or request a call back from an expert tutor and they’ll be happy to help you try and get those marks needed to pass.

The Academic Support Team opening times are:

Monday - Thursday: 8:00 am - 8:00 pm

Friday: 8:00 am - 5:30 pm

Saturday: 9:00 am - 5:00 pm

Sunday (and UK Bank Holidays): 9:00 am - 1:00 pm