Structure and pathways

CFA Level 3 has three specialised pathways to choose from - Portfolio Management, Private Wealth, and Private Markets. Candidates can select the pathway that relates to their interests and ambitions. Each Level 3 pathway has a common core curriculum, which provides the knowledge and skills for investment management. This is supplemented by specialised content for the chosen pathway.

The Level 3 “Common Core” curriculum makes up 65-70% of the total exam topic weight, while the remaining 30-35% relates to the chosen pathway. To pass Level 3, you’ll be examined on the topics depending on your chosen pathway.

It's important to note that the CFA Charter achieved upon successful completion of the Program will be the same regardless of the pathway chosen. Therefore, candidates should select a pathway based on their individual interests and aspirations.

All assessments are computer-based exams (CBE).

Entry requirements

To register for your Level 3 exam, you need to have passed Level 2.

Pathways

You can choose one of three pathways. The study materials provided will relate to the selected Pathway.

Pathway One

Portfolio Management

Learn about constructing, managing, optimising, and measuring portfolios of public market equity, fixed income, and derivative securities.

- Index-based equity strategies

- Active equity investing: strategies

- Active equity investing: portfolio construction

- Liability driven and index based fixed income strategies

- Fixed-income active management: yield curve strategies

- Fixed-income active management: credit strategies

- Case study in portfolio management: institutional

- Trade strategy and execution

Pathway Two

Private Markets

Learn about private market investing from the perspective of the General Partner (GP). Cover all key steps in the workflow from deal-sourcing and diligence to exit, and builds on key valuation and other competencies in the CFA Program from all four asset class domains.

- Private Investments and Structures

- General Partner and Investor Perspectives

- Private Equity

- Private Debt

- Private Special Situations

- Private Real Estate Investments

- Infrastructure Investments

Pathway Three

Private Wealth

Gain a global perspective and learn the principles for serving High Net Worth clients. This pathway extends beyond simple investment management and financial planning to cover areas such as family management, philanthropy and serving star athletes.

- The Private Wealth Management Industry

- Working With The Wealthy

- Wealth Planning

- Investment Planning

- Preserving the Wealth

- Advising the Wealthy

- Transferring the Wealth

Study packages for 2025 sittings

Whatever your learning style, we have a study package for you.

Do you prefer structured learning? We offer classroom, live online or a blended approach. Or do you prefer self study? Then we offer a distance learning package where you can study at your own pace.

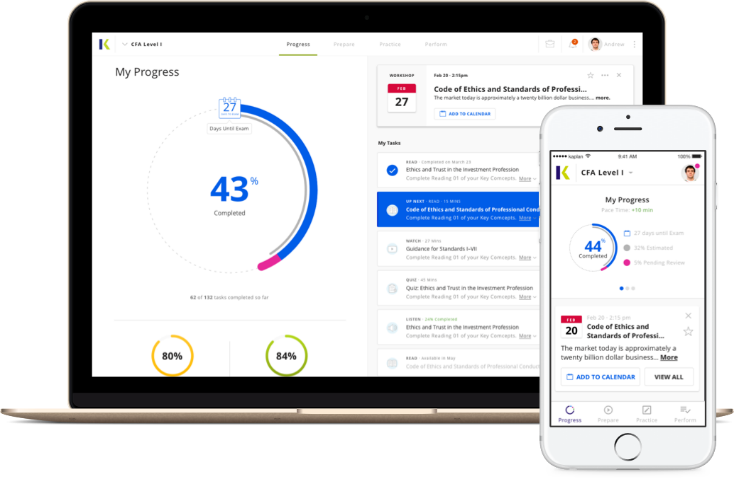

Our flexible study packages have been designed to maximise your time, keep you on track, and help you pass your exam. Whichever study package you choose, you’ll receive high quality Schweser study materials, access to our online study portal, and continuous support right up to your exam. To see which study package is best for you, please see our infographic (PDF 128KB).

Try FREE for 7 days

Study methods available for this qualification

expand_more Study method comparison table

| Features |

Classroom |

Blended |

Live Online |

Distance Learning |

| Classroom Tuition |

check |

remove |

remove |

remove |

| Live Online Tuition |

remove |

check |

check |

remove |

Schweser OnDemand

Tuition |

remove |

remove |

remove |

check |

| Tuition Recordings |

check |

check |

check |

remove |

| Classroom Revision |

check |

check |

remove |

remove |

| Live Online Revision |

remove |

remove |

check |

remove |

Schweser OnDemand

Revision |

remove |

remove |

remove |

check |

| Revision Recordings |

check |

check |

check |

remove |

| Core Study Materials |

check |

check |

check |

check |

| Pass Protection |

check |

check |

check |

check |

All of our packages include the following study materials to help you pass and progress.

-

Online Portal

Strategically placed weekly tasks.

-

SchweserNotes™

Condensed study notes.

-

Module Videos

40+ hours of recorded videos.

-

SchweserPro™ QBank

Practice questions and videos.

-

Checkpoint Exams

3 exams with practice questions.

-

Online Mocks

6 full-length exam simulators.

-

Schweser's Secret Sauce®

Insights and exam tips.

-

QuickSheet

Summary of formulas, definitions, and concepts.

Complete packages

Recommended

Structured teaching keeps you on track and motivated with scheduled classes.

- Classroom tuition

- Classroom revision

- Schweser study material

- Pass Protection

- Work your way through the curriculum with face-to-face classroom tuition

- Tuition is spread across six days during the weekdays or weekends, or 14 evenings

- Catch up on missed material with tuition classroom recordings.

- In addition to face-to-face classroom revision, get exam confident with testing at every stage of your studies

- You'll have access to thousands of practice questions to work through in the online question bank and Q&A book

- You’ll get a MindMap book that boils down the core points of each study session into a handy revision book - ensuring you’ve covered all of the Learning Outcome Statements.

- With Schweser's Secret Sauce®, you'll get plenty of exam tips on how to prepare and apply your knowledge on exam day.

- You can catch up on missed material with revision classroom recordings.

The CFA exams can be tough, but if you don’t pass, everything’s not lost. With Kaplan's Pass Protection (PDF 60KB) you can attend our revision course for free until you pass your exam, and you may be eligible to receive the same material package for the next exam sitting for free. T&C’s apply.

All your essential study materials are included in the package. However, you have the option to purchase the Texas BAII+ Professional Calculator.

Structured teaching keeps you on track and motivated with scheduled classes.

- Live online tuition

- Classroom revision

- Schweser study material

- Pass Protection

- Work your way through the curriculum with live online tuition

- Tuition is spread across 14 evenings

- You can catch up on missed material with tuition classroom recordings.

- In addition to face-to-face classroom revision, get exam confident with testing at every stage of your studies.

- You'll have access to thousands of practice questions to work through in the online question bank and Q&A book

- You’ll get a MindMap book that boils down the core points of each study session into a handy revision book - ensuring you’ve covered all of the Learning Outcome Statements.

- With Schweser's Secret Sauce®, you'll get lots of exam tips on how to prepare and apply your knowledge on exam day.

- You can catch up on missed material with revision classroom recordings.

The CFA exams can be tough, but if you don’t pass, everything’s not lost. With Kaplan's Pass Protection (PDF 60KB) you can attend our revision course for free until you pass your exam, and you may be eligible to receive the same material package for the next exam sitting for free. T&C’s apply.

All your essential study materials are included in the package. However, you have the option to purchase the Texas BAII+ Professional Calculator.

Structured teaching keeps you on track and motivated with scheduled classes.

- Live online tuition

- Live online revision

- Schweser study material

- Pass Protection

- Work your way through the curriculum with live online tuition.

- Tuition is spread across 14 evenings

- You can catch up on missed material with tuition classroom recordings.

- In addition to live online revision, get exam confident with testing at every stage of your studies.

- You'll have access to thousands of practice questions to work through in the online question bank and Q&A book

- You’ll get a MindMap book that boils down the core points of each study session into a handy revision book - ensuring you’ve covered all of the Learning Outcome Statements.

- With Schweser's Secret Sauce®, you'll get lots of exam tips on how to prepare and apply your knowledge on exam day.

- You can catch up on missed material with revision classroom recordings.

The CFA exams can be tough, but if you don’t pass, everything’s not lost. With Kaplan's Pass Protection (PDF 60KB) you can attend our revision course for free until you pass your exam, and you may be eligible to receive the same material package for the next exam sitting for free. T&C’s apply.

All your essential study materials are included in the package. However, you have the option to purchase the Texas BAII+ Professional Calculator.

laptop

laptop

Distance Learning

Self study at your own pace and when it's convenient with OnDemand videos.

- OnDemand tuition

- OnDemand revision

- Schweser study material

- Pass Protection

- 50 hours of OnDemand Tuition classes led by an expert tutor

- 30 hours of OnDemand Revision classes, lead by an expert tutor.

- With Schweser's Secret Sauce®, you'll get lots of exam tips on how to prepare and apply your knowledge on exam day.

- You’ll get Mind Maps and Schweser Review Workshop Questions

The CFA exams can be tough, but if you don’t pass, everything’s not lost. With Kaplan's Pass Protection (PDF 60KB) you may be eligible to receive the same material package for the next exam sitting for free.

All your essential study materials are included in the package. However, you have the option to purchase the Texas BAII+ Professional Calculator.

Revision only courses

As an alternative to the complete packages, you can choose an individual revision course without the supporting Kaplan Schweser study materials.

people

Classroom Revision only

Classroom revision without the Kaplan Schweser study materials.

laptop

Live Online Revision only

Live Online revision without the Kaplan Schweser study materials.

Timetables - Classroom and Live Online

Classroom tuition courses take place over six days (from 9-5pm) or 14 evenings (from 6-9pm). Classroom revision courses take place over five days (from 9-5pm) or 10 evenings (from 6-9pm).

date_range View timetables

location_on Classroom location

We have classes in London:

London Bridge training centre: 179-191 Borough High Street, London Bridge, London, SE1 1HR

For further information on mainland European classes, see our partner website Top Finance.

Optional extras

We offer a number of optional extras that can be beneficial as part of your studies:

Optional

Schweser Mock Exam

The Online Schweser Mock Exam is as close as you can get to the actual exam in format, difficulty, and length. With our new simulation, it will help to develop your test-taking, identify your weak areas as well as giving you a real exam experience. After the simulation, you can view answer explanations and check your score compared to those of other candidates.

from £75.00 per exam

(VAT not applicable)

Learn more

Optional

Texas BAII+ Professional Calculator

One of the recommended CFA Calculators, as well as the calculator that will be referenced in classes.

£81.00 Including UK delivery

(£67.50 excl. VAT)

Inhouse training

Our public classroom courses run in central London. Like many of our courses, we can also offer these courses inhouse for your team or organisation. Please contact us on 020 7920 3060 or email us at citybookings@kaplan.co.uk to find out more about how we can help train your team.

Study packages for 2026 sittings

Whatever your learning style, we have a study package for you.

Do you prefer structured learning? We offer classroom, live online or a blended approach. Or do you prefer self study? Then we offer a distance learning package where you can study at your own pace.

Our flexible study packages have been designed to maximise your time, keep you on track, and help you pass your exam. Whichever study package you choose, you’ll receive high quality Schweser study materials, access to our online study portal, and continuous support right up to your exam. To see which study package is best for you, please see our infographic (PDF 128KB).

Try FREE for 7 days

Study methods available for this qualification

expand_more Study method comparison table

| Features |

Classroom |

Blended |

Live Online |

Distance Learning |

| Classroom Tuition |

check |

remove |

remove |

remove |

| Live Online Tuition |

remove |

check |

check |

remove |

Schweser OnDemand

Tuition |

remove |

remove |

remove |

check |

| Tuition Recordings |

check |

check |

check |

remove |

| Classroom Revision |

check |

check |

remove |

remove |

| Live Online Revision |

remove |

remove |

check |

remove |

Schweser OnDemand

Revision |

remove |

remove |

remove |

check |

| Revision Recordings |

check |

check |

check |

remove |

| Core Study Materials |

check |

check |

check |

check |

| Pass Protection |

check |

check |

check |

check |

All of our packages include the following study materials to help you pass and progress.

-

Checkpoint Exams

3 exams with practice questions.

-

Online Mocks

6 full-length exam simulators.

-

Schweser's Secret Sauce®

Insights and exam tips.

-

QuickSheet

Summary of formulas, definitions, and concepts.

Complete packages

Recommended

Structured teaching keeps you on track and motivated with scheduled classes.

- Classroom tuition

- Classroom revision

- Schweser study material

- Pass Protection

- Six days of face-to-face classroom tuition

- Catch up on missed material with tuition classroom recordings

- Pro-active tutor contact to keep you on track and access to the Schweser Community.

- Five days of face-to-face classroom revision

- Question practice and exam tips using revision Q&As, Mindmaps, and the ‘Secret Sauce’ book

- Revision recordings for final review.

The CFA exams can be tough, but if you don’t pass, everything’s not lost. With Kaplan's Pass Protection (PDF 60KB) you can attend our revision course for free until you pass your exam, and you may be eligible to receive the same material package for the next exam sitting for free. T&C’s apply.

All your essential study materials are included in the package. However, you have the option to purchase the Texas BAII+ Professional Calculator.

Structured teaching keeps you on track and motivated with scheduled classes.

- Live online tuition

- Classroom revision

- Schweser study material

- Pass Protection

- 14 evenings of live online tuition

- Catch up on missed material with tuition classroom recordings

- Pro-active tutor contact to keep you on track and access to the Schweser Community.

- Five days of face-to-face classroom revision

- Question practice and exam tips using revision Q&As, Mindmaps, and the ‘Secret Sauce’ book

- Revision recordings for final review.

The CFA exams can be tough, but if you don’t pass, everything’s not lost. With Kaplan's Pass Protection (PDF 60KB) you can attend our revision course for free until you pass your exam, and you may be eligible to receive the same material package for the next exam sitting for free. T&C’s apply.

All your essential study materials are included in the package. However, you have the option to purchase the Texas BAII+ Professional Calculator.

Structured teaching keeps you on track and motivated with scheduled classes.

- Live online tuition

- Live online revision

- Schweser study material

- Pass Protection

- 14 evenings of live online tuition

- Catch up on missed material with tuition classroom recordings

- Pro-active tutor contact to keep you on track and access to the Schweser Community.

- 10 evenings of live online revision

- Question practice and exam tips using revision Q&As, Mindmaps, and the ‘Secret Sauce’ book

- Revision recordings for final review.

The CFA exams can be tough, but if you don’t pass, everything’s not lost. With Kaplan's Pass Protection (PDF 60KB) you can attend our revision course for free until you pass your exam, and you may be eligible to receive the same material package for the next exam sitting for free. T&C’s apply.

All your essential study materials are included in the package. However, you have the option to purchase the Texas BAII+ Professional Calculator.

laptop

laptop

Distance Learning

Self study at your own pace and when it's convenient with OnDemand videos.

- OnDemand tuition

- OnDemand revision

- Schweser study material

- Pass Protection

- 50 hours of OnDemand Tuition classes led by an expert tutor

- Access to the Schweser Community

- 30 hours of OnDemand Revision classes, lead by an expert tutor.

- With Schweser's Secret Sauce®, you'll get lots of exam tips on how to prepare and apply your knowledge on exam day.

- You’ll get Mind Maps and Schweser Review Workshop Questions

The CFA exams can be tough, but if you don’t pass, everything’s not lost. With Kaplan's Pass Protection (PDF 60KB) you may be eligible to receive the same material package for the next exam sitting for free.

All your essential study materials are included in the package. However, you have the option to purchase the Texas BAII+ Professional Calculator.

Revision only courses

As an alternative to the complete packages, you can choose an individual revision course without the supporting Kaplan Schweser study materials.

people

Classroom Revision only

Classroom revision without the Kaplan Schweser study materials.

laptop

Live Online Revision only

Live Online revision without the Kaplan Schweser study materials.

Timetables - Classroom and Live Online

Classroom tuition courses take place over six days (from 9-5pm) or 14 evenings (from 6-9pm). Classroom revision courses take place over five days (from 9-5pm) or 10 evenings (from 6-9pm).

date_range View timetables

location_on Classroom location

We have classes in London:

London Bridge training centre: 179-191 Borough High Street, London Bridge, London, SE1 1HR

Optional extras

We offer a number of optional extras that can be beneficial as part of your studies:

Optional

Schweser Mock Exam

The Online Schweser Mock Exam is as close as you can get to the actual exam in format, difficulty, and length. With our new simulation, it will help to develop your test-taking, identify your weak areas as well as giving you a real exam experience. After the simulation, you can view answer explanations and check your score compared to those of other candidates.

from £75.00 per exam

(VAT not applicable)

Learn more

Optional

Texas BAII+ Professional Calculator

One of the recommended CFA Calculators, as well as the calculator that will be referenced in classes.

£81.00 Including UK delivery

(£67.50 excl. VAT)

Inhouse training

Our public classroom courses run in central London. Like many of our courses, we can also offer these courses inhouse for your team or organisation. Please contact us on 020 7920 3060 or email us at citybookings@kaplan.co.uk to find out more about how we can help train your team.

Exams, sittings and resits

Exams

The exams are computer based testing and run two to four times a year. For more information on the frequency of sittings please refer to CFA Institute®.

Please be aware, it's your responsibility to register with the CFA Institute® for exam entry with the cost of the exam depending on the date of registration. There is also a one-time program enrollment fee when you register for the CFA Level I exam for the first time.

Exam results are available within 90 days of the exam date. All candidates receive a “pass” or “did not pass” result as well as details as to performance per topic.

You’ll need to pass Level 2 of the CFA Program before registering for Level 3. The CFA institute allow you a total of six attempts per exam level.

Syllabus weighting

| Level 3 topic |

Approximate exam weight |

| Ethical and Professional Standards |

10-15% |

| Derivatives and Risk Management |

10-15% |

| Portfolio Construction |

15-20% |

| Asset Allocation |

15-20% |

| Performance Measurement |

5-10% |

|

Choice of Pathway:

Portfolio Management

Private Markets

Private Wealth

|

30-35% |

| Total |

100% |

How long does it take to pass?

The examining body recommends around 300 hours of study for each level in the CFA charter, although some candidates will need more or less time, depending on their individual backgrounds and experience.

It is possible to complete the CFA Program in two years but with a recommended study time of 300 hours per level, it takes most people three to four years to complete the three three levels.

What are pass rates like?

For pass rate information visit CFA Institute. As a training provider we are not able to report our own pass rates in accordance with CFA Institute guidelines.

What CFA resits are available?

We do everything we can to help you pass your CFA exam first time. However, should you need a second chance, then don’t worry. With Pass Protection, there are lots of ways we can support you as you prepare for your exam resit. For further information, please refer to our pass protection policy (PDF 60KB).

download CFA Resit Enrolment Form 2025 (PDF)

download CFA Resit Enrolment Form 2026 (PDF)

Can Kaplan help if I fail an exam but studied with another provider?

If you have failed elsewhere with another prep provider, we'd like to help save you some money. We're pleased to be able to offer you 50% off our study packages. You'll just need to send us an invoice from your previous prep provider.

More information about our 50% off study packages

Study Materials and Delivery Costs

We offer a comprehensive range of study materials to enhance your learning experience. They’ve been designed to keep you on track and stay motivated on your learning journey. These include hard copy books as well as online resources on Schweser’s study portal.

Core materials included with all packages

-

Getting Started Guide

Explains how to use the resources effectively to maximise your chance of passing the exam.

-

Schweser Online Study Portal

Includes dashboard with activity feed and performance metrics to keep you on track and motivated.

-

Schweser Online Mock Exam 1 – 6

Practice taking the computer-based test before exam day with the online Schweser mock exam. This realistic exam simulates the interface, format, difficulty, and length of the actual CFA exam.

-

SchweserNotes™

Clear, concise study notes and examples that cover every learning outcome statement (downloadable as eBooks as well as in print). These notes also include module quizzes and topic assessments which can demonstrate your level of mastery of a topic and where you need to focus additional attention.

-

Quicksheet

A compact study tool summarising key formulae, definitions and concepts (available online, downloadable as an eBook as well as in print).

-

SchweserPro™ QBank

Thousands of unique online practice questions designed to assess and adapt to your understanding of the curriculum.

-

Schweser Checkpoint Exams

Three key tests that you will be prompted to work through online during your studies. These mimic the difficulty and format of the actual exam. Performance reports then highlight your understanding and weak areas where more review is needed.

-

Schweser's Secret Sauce®

Take this compact book anywhere you go, printed or eBook, for a concise review of the CFA Program curriculum. Secret Sauce provides insights and exam tips on how to effectively prepare and apply your knowledge on exam day.

-

Kaplan Schweser Community

An exclusive online study forum where you can post questions and engage in discussions with CFA experts and your fellow candidates. With more than 15,000 users, we’ve already become the most used online forum hosted by an exam prep provider for advanced financial designations.

-

Schweser CFA Institute Question Review Videos

Videos walk you through the end-of-reading questions from the CFA Institute Program curriculum. You’ll get expert advice and strategies from CFA instructors as they guide you through the questions.

Additional materials come with the following packages

- Tuition classroom recordings

- Revision classroom recordings

- Tuition course slides

- Mindmaps and Q&A book

- OnDemand Tuition with Workbooks

- OnDemand Revision with Workbooks

Study Material availability

Schweser releases study materials on a piecemeal basis as soon as they are available, normally at least six months ahead of relevant exam windows. You may receive more than one release/delivery of eBooks/hard copy materials. Release dates can be subject to change depending on the size of the new curriculum changes.

Delivery costs

Materials are delivered to the address you provide us (and must be signed for on delivery). For detailed information on delivery prices please refer to our delivery page.

Kaplan Schweser online study portal

Kaplan Schweser’s online portal provides access to a wide variety of resources to help you prepare for your exams. It also hosts all our Live Online tuition and revision classes.

Online features

Depending on the study package you choose, features can include the following:

- View your online materials in one place and access your content in a few clicks

- Take the guesswork out of your study plan with strategically placed weekly tasks

- Track your performance against that of other candidates

- Complete tests and get instant feedback

- Access on mobile, tablet and computer

For more information on technical support available and minimum system requirements for Kaplan Schweser’s online portal, visit the Schweser portal technical support.

Access duration

You can access your content from 48 working hours of purchase (subject to availability) until your examination date.

Try FREE for 7 days

Tutor support

We'll support you every step of the way throughout your CFA learning experience with us. Our tutors are available for any questions or worries you might have.

Course pricing and funding options

Pricing structure

Below are our study package prices. The only additional costs will be delivery and if you decide to purchase any optional extras.

| Package |

Full Price (excl. VAT) |

Full Price (incl. VAT) |

| Classroom |

£2,850 |

£3,323 |

| Blended |

£2,390 |

£2,771 |

| Live Online |

£1,930 |

£2,219 |

| Distance Learning |

£950 (VAT not applicable) |

| Classroom Revision Only |

£1,235 |

£1,482 |

| Live Online Revision only |

£775 |

£930 |

downloadStudy package comparison 2025 (PDF)

| Package |

Full Price (excl. VAT) |

Full Price (incl. VAT) |

| Classroom |

£2,905 |

£3,387 |

| Blended |

£2,440 |

£2,829 |

| Live Online |

£1,975 |

£2,271 |

| Distance Learning |

£999 (VAT not applicable) |

| Classroom Revision Only |

£1,260 |

£1,512 |

| Live Online Revision only |

£795 |

£954 |

download Study package comparison 2026 (PDF)

*Save 20% on 2024 Classroom and Blended study packages if you book online by 7th June 2023. Your saving will be applied automatically upon checkout.

Funding options

Invoice your employer

Your employer may fund the costs of your studies if you’re already working in a related field and want to develop your learning. You’ll need to speak to them to see if you’re eligible and confirm that they’re happy to pay for your studies.

Learn more about invoice your employer

Payment plans

Our CFA packages are covered with our interest-free payment plan, providing the total cost is £500 minimum (including VAT). The plan lets you spread the cost of your studies over a period of up to 12 months, with no extra costs.

Learn more about payment plans

How to enrol

The quickest way to enrol is to select your course online. You can also call us on 020 7920 3060 or enrol with a form which you can download, fill out your details and email to citybookings@kaplan.co.uk.

download Download enrolment form 2025 (PDF)

download Download enrolment form 2026 (PDF)