If you’re preparing for your CIMA BA3 exam, don’t worry. We’ll explore several questions and concerns to help you get the most out of your revision.

This includes:

- The core areas and topics of the exam

- How the exam is structured

- The benefits of studying CIMA BA3

- Challenges

- Example question and answer

- Additional resources

What are the exam topics?

The CIMA BA3 exam will assess your knowledge across four main syllabus areas. These are:

- Accounting principles, concepts and regulations (10%) - You will be introduced to basic accounting concepts, such as cash and profit, assets and revenue.

- Recording accounting transactions (50%) - You will start to apply the principles of double-entry bookkeeping and will be able to complete a trial balance. The concepts of amortisation and depreciation will be introduced in relation to the relevant international accounting standards.

- Preparation of accounts for single entities (30%) - You will prepare financial statements from a trial balance and accounting entries for inventories.

- Analysis of financial statements (10%) - By calculating and interpreting accounting ratios, you will gain further insight into the reasons for changes in an organisation’s performance.

How is the exam structured?

The two-hour computer-based exam consists of 60 compulsory questions, each with one or more parts.

The assessment will use various objective test question styles and types, such as multiple choice, multiple response, number entry, drag and drop, drop down, and hot spot.

Often, around two to four questions will also relate to a short common scenario.

Common challenges and tips for the CIMA BA3 exam

The CIMA BA3 subject heavily involves double-entry bookkeeping, requiring a significant effort to master debits and credits. Preparing financial statements and applying International Financial Reporting Standards (IFRS) can also be challenging as they demand a strong understanding of concepts like inventory valuation and how depreciation is calculated. Learners often find it difficult to recall the precise definitions of terms such as accruals and prepayments.

It also often comes as a surprise when learners come across the topic of errors in financial recordkeeping. They often assume that entries are accurate as most organisations now use accounting software.

However, mistakes can easily creep in when inputting a transaction or processing third-party information. Bank reconciliation, for example, is a great way to verify the correct recording of customer receipts and supplier payments.

Addressing these challenges

The 73% pass rate should act as reassurance that learners initially feel the volume and complexity of the paper is overwhelming. Double-entry bookkeeping can seem daunting, but mnemonics and other memory tools can significantly help. Creating memory cards with meanings of terms, or even with formulae for calculating various ratios, will help to prompt your visual memory.

We can’t deny that hard work and practising questions are the key to exam success. However, exam technique plays a crucial role. I would advise prioritising and answering shorter and easier questions first, which should help manage the time pressure of an exam. Doing this will also provide the opportunity to glance at all the questions in the exam, gain some marks as soon as possible, and then focus on the longer, descriptive questions.

Remember to make use of the ‘review’ section as it will help you to identify any incomplete questions. It’s possible to flag a question and return to it later. But ensure you attempt all questions to give yourself the best chance of passing.

How does the CIMA BA3 exam subject help towards my career and/or studies?

While it can be challenging, the CIMA BA3 subject provides a foundational understanding of other subjects within the ‘F’ pillar of the full professional qualification. It supports career advancement in the industry, leading to roles such as financial accountant, financial controller, or financial director.

A strong grasp of transaction recording and regulatory compliance is essential for accountants in all businesses. In your job role, you may be involved in preparing year-end financial statements for audit, which requires a knowledge of sales tax, accruals, prepayments, payroll, and inventory. An organisation may also undertake significant investment in non-current assets, which need to be properly accounted for.

Studying the CIMA BA3 subject also equips you with the knowledge to assist financial decision-makers and business leaders in interpreting and acting on financial information. It also provides the skills necessary for bookkeeping if you opt to start up your own business or go into bookkeeping for other entities, potentially including auditing clients’ financial statements.

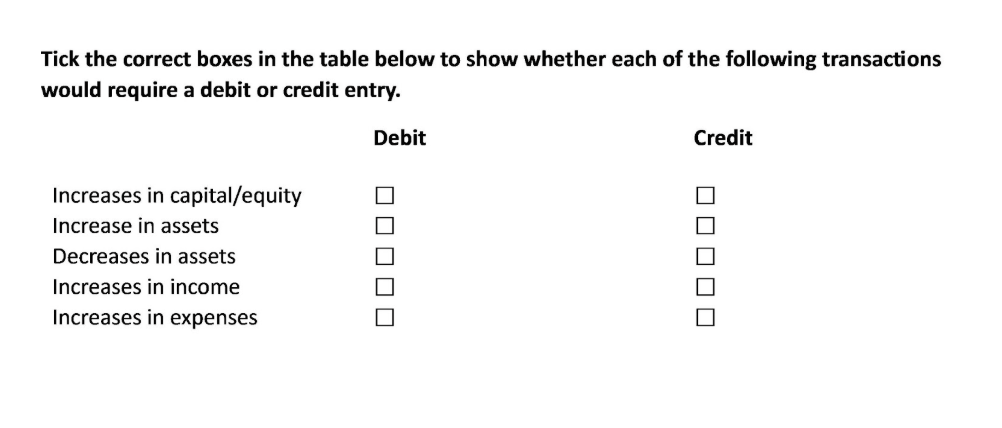

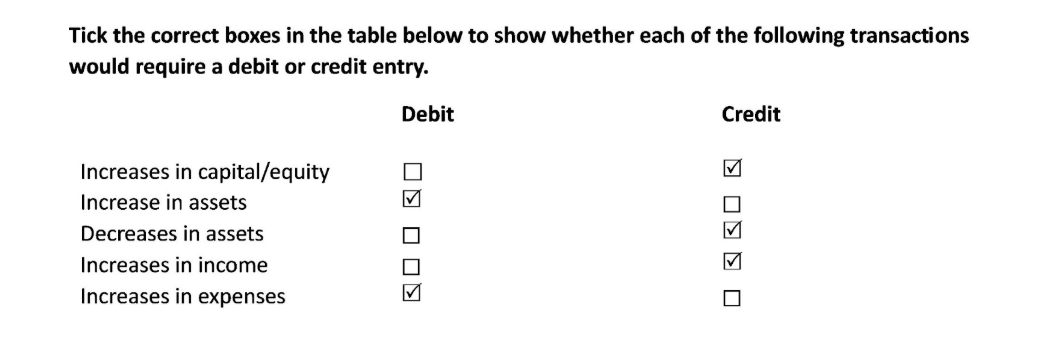

Example question and answer

Answer

Mnemonics are a highly effective way to commit new concepts to memory. DEAD CLIC is a very popular mnemonic for developing a basic understanding of fundamental concepts behind debit and credit:

D - Debit to increase

- E - Expenses

- A - Assets

- D - Drawings (or dividends)

C - Credit to increase

- L - Liabilities

- I - Income

- C - Capital

Additional support and resources

When studying on a course with Kaplan, you will have access to the Academic Support team via the ‘contact a tutor’ option on your MyKaplan. They are available seven days a week and can support you with any tricky topics via live chat, email, or by requesting a call back.

If you have any additional learning needs, get in touch with our inclusion team, who can support you.

Read our blog for additional tutor tips for other exam subjects. Additionally, our Kaplan Publishing website offers the CIMA BA3 exam kit and revision cards, which can help you during your revision.

Feeling ready?

Working towards a specific date can significantly boost your productivity when it comes to revising for the exam. Find your local Kaplan centre and book your exam today. Good luck.