If you are preparing for your ACCA Financial Management exam, don’t worry. In this article, we explore several questions and concerns to help you get the most out of your revision.

This includes:

- The objective and core areas of the exam

- How the exam is structured

- The benefits of studying ACCA Financial Management

- Challenges

- An example exam question

- Additional resources

What are the exam topics?

The first two areas of the syllabus consider the purpose of the finance manager and also the external financial management environment.

The next three areas of the syllabus covers working capital management, investment appraisal, and business finance.

The final two syllabus areas look at valuing businesses and also how to manage foreign currency and interest rate risk.

What is the exam structure?

The ACCA FM exam contains three sections.

| Section | Number of marks |

|---|

Section A

15 two-mark Objective questions (all or nothing, no partial marks)

Mixture of narrative and calculation questions likely to be from all syllabus areas

| 30 marks |

Section B

Three Scenarios with five questions on each scenario worth two marks each (again all or nothing, no partial marks)

Mixture and narrative and calculation questions which could be from any syllabus area

| 30 marks |

Section C

Comprises two questions worth 20 marks each. The questions will likely be, but not always, broken down into typically between two and six requirements. Section C of the exam focuses on Investment Appraisal, Working Capital Management and Business Finance so there will not be questions based on Business Valuation and/or Risk Management in this area of the exam.

| 40 marks |

How does the ACCA Financial Management exam subject help towards my studies and career?

The ACCA FM unit builds on knowledge gained from studying ACCA Management Accounting at the Applied Knowledge level, or alternatively, you may have studied AAT or have a university degree. This exam will prepare you for the ACCA AFM unit in the Strategic Professional level.

In this unit, you’ll learn how business objectives, strategy, and stakeholders connect, and how external factors like government policy and financial markets affect decision-making. This makes FM valuable whether you’re already in a finance role or planning to move into one.

Key areas covered include:

- Working capital management - balancing profitability and liquidity

- Investment decisions - evaluating projects, cash flows, and their impact on the business

- Financing decisions - choosing the right sources of finance and calculating their cost.

- Risk and return - understanding how financing choices affect the cost of capital and company value.

- Valuation - learning how to value companies, shares, and bonds.

- Risk management - recognising and managing foreign currency and interest rate risks.

In short, ACCA FM gives you the practical tools to make sound financial decisions, manage risk, and add real value to organisations - skills that are essential for progressing in your studies and building a successful finance career.

What are some of the key challenges for the ACCA Financial Management exam?

The size of the syllabus! The ACCA FM syllabus is huge and one of the largest at the Applied Skills Level. Although there is some assumed knowledge, especially with regard to Investment Appraisal, much of the knowledge learned is new.

Learners also do not typically do NPV and WACC calculations on a daily basis at work, so often struggle applying these to exam style questions for the first time.

Additionally, 60% of the exam is all or nothing, with no partial marks, meaning accuracy is important, and it is no longer all multiple choice. Reading and practicing questions is therefore very important.

How would you address these key challenges?

- Ensure you study the whole syllabus.

- Create a study plan and stick to it, but avoid burnout by taking short breaks during study sessions to maintain focus and motivation.

- Do not get demotivated by any setbacks. Try and look at the positives and improve.

However, do note Section C Questions will concentrate on Working Capital Management, Investment Appraisal and Business Finance so when completing Section C, use the ACCA Software to practice using the software in an efficient manner.

For written questions, learn to present your answers in a clear and concise manner using paragraphs and sub-headings.

For NPV and WACC Questions, practice layout of your workings and proforma so they are presented to the marker in a professional format.

One of the best ways to enjoy studying the ACCA FM unit is by imagining what you would do, and what decisions you would make, if you were running an organisation.

Example question and answer

The below question is a typical ACCA FM Investment Appraisal question from syllabus area D focussing on investment appraisal techniques allowing for inflation and taxation in discounted cash flow.

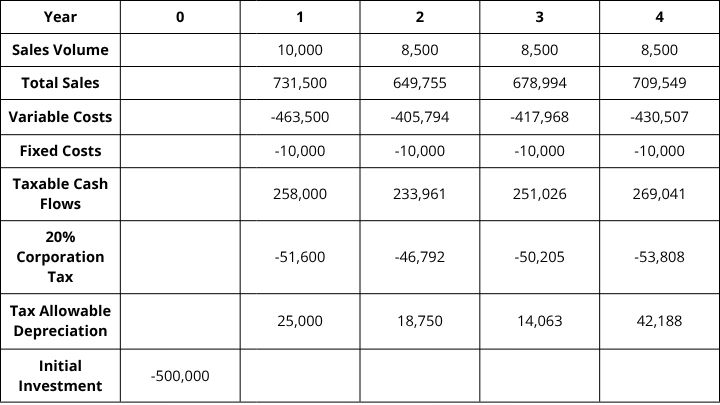

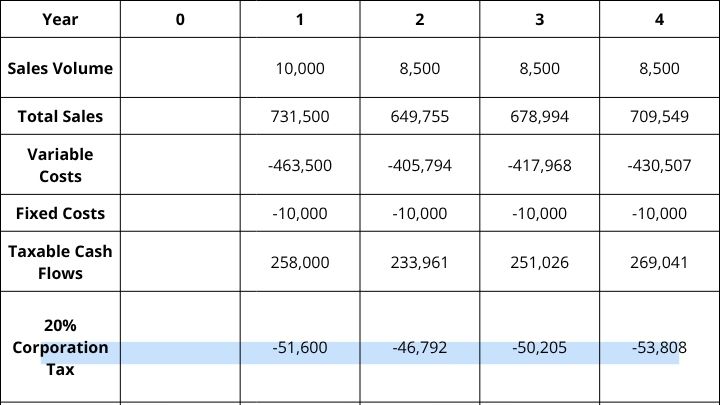

The company in question here, Galle Co, manufactures car batteries and they are evaluating the introduction of a new battery called the G-Power Excel (GPE). Sales for the first year are expected to be 10,000 units but there is uncertainty over the sales volumes for the remainder of the project’s life.

The key to approaching the expected NPV calculation in the most efficient and correct way is to work out the expected sales volumes based upon the years 2 to 4 sales predications. There is a 30% chance that the sales volumes could drop to 5,000 units per year for these years which means there is a 70% chance that sales volumes will remain at the year 1 sales volume of 10,000 units.

We can do an expected values calculation using the probabilities provided to ascertain that 8,500 units is the sales volume that should be used for cash flows in years 2 to 4. An expected value is an average expectation if this scenario is played out over and over again.

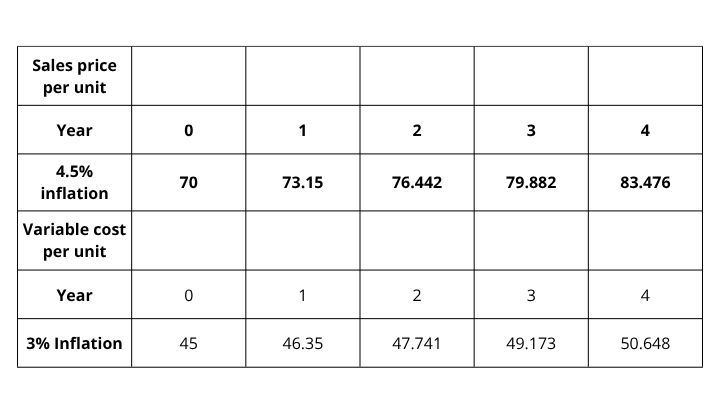

Once the sales volume figures have been ascertained, these can then be used to calculate revenue and variable costs in each year. Care needs to be taken to apply inflation correctly to the sales price and variable cost per unit respectively.

Inflation of 4.5% should be applied to sales price each year. Inflation of 3% should also be applied to variable costs.

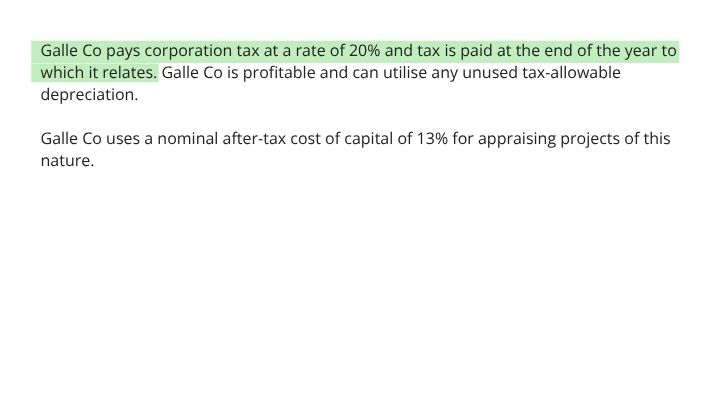

Fixed Costs remain constant at $10,000 per year. The correct taxable Cash Flow can then be calculated. Note, the question states that tax is to be paid in the year at the end of the year to which it relates, therefore, it should not be deferred by one year in this question.

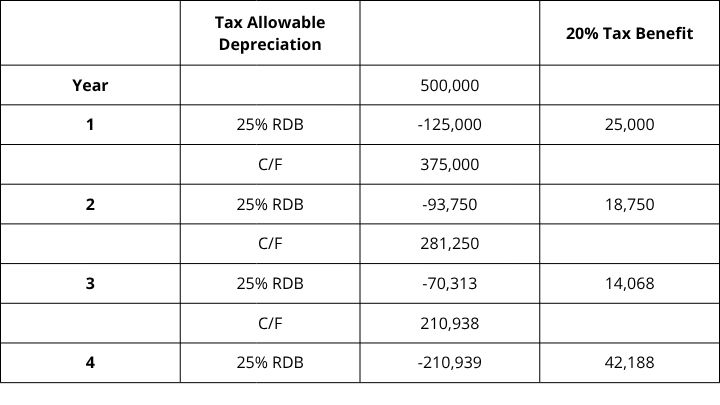

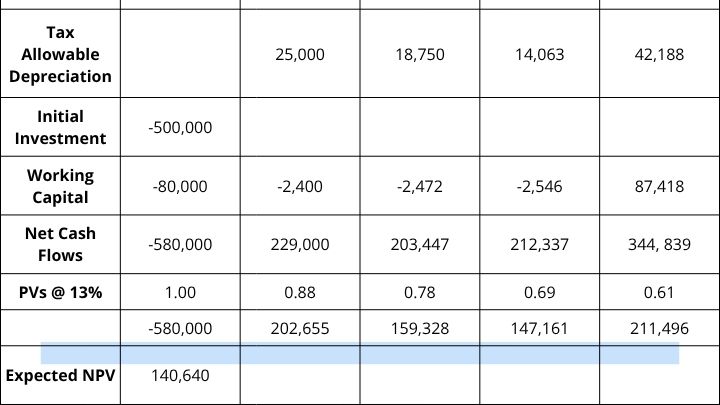

Remember with Tax Allowable Depreciation that it is important to clearly show your workings so that they can be fully understood and followed by the marker. Therefore, partial marks can be awarded if necessary if there are some slight errors.

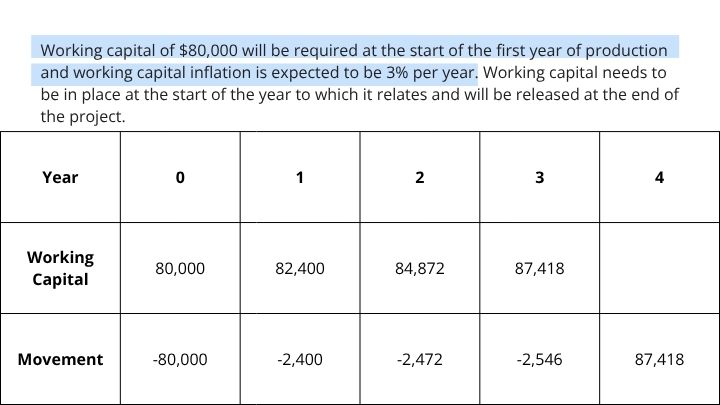

The working capital cash flows were not dependent on sales and therefore were more straightforward.

It is important to remember with Working Capital that we are only interested in the annual movement in working capital, not the total amount required. Additionally, Working Capital is recovered at the end of the project. Injections of Working Capital are cash outflows, whilst the recovery of working capital is a cash inflow.

At this point, the net cash flows for each year have been calculated. These are then discounted at 13% and the expected NPV can be calculated. You can use the spreadsheet function or alternative work our each years PV and sum them up.

Finally, for two marks, candidates were expected to briefly comment on the project’s financial acceptability based on the expected NPV calculation.

The first mark can be for commenting on the result of the $140,640 NPV i.e. it is positive and therefore acceptable. If the candidate made an error resulting in a negative NPV, then this would also be acceptable.

The second mark would need to discuss the “expected” part of the calculation. Any reasonable discussion using the differing sales volume projections is required.

Additional support and resources

If you’re not already studying ACCA Financial Management with us at Kaplan, give yourself the best chance to pass the exam with our ACCA FM course. With four study methods, you’ll find a course that’s perfect for you.

When studying with Kaplan, you will have access to the Academic Support team via the ‘contact a tutor’ option on your MyKaplan. They are available seven days a week and can support you with any tricky topics via live chat, email, or by requesting a call back.

And if you have any additional learning needs, get in touch with our inclusion team who can support you.

Practicing exam-standard questions in timed conditions is essential when preparing for your real exam. Be encouraged to practice questions in the ACCA practice platform when possible.

Alternatively, Kaplan Publishing, an ACCA Content Partner, also offers ACCA Study Texts, Exam Kits, and Pocket Notes - which cover the full syllabus and help you feel exam confident.